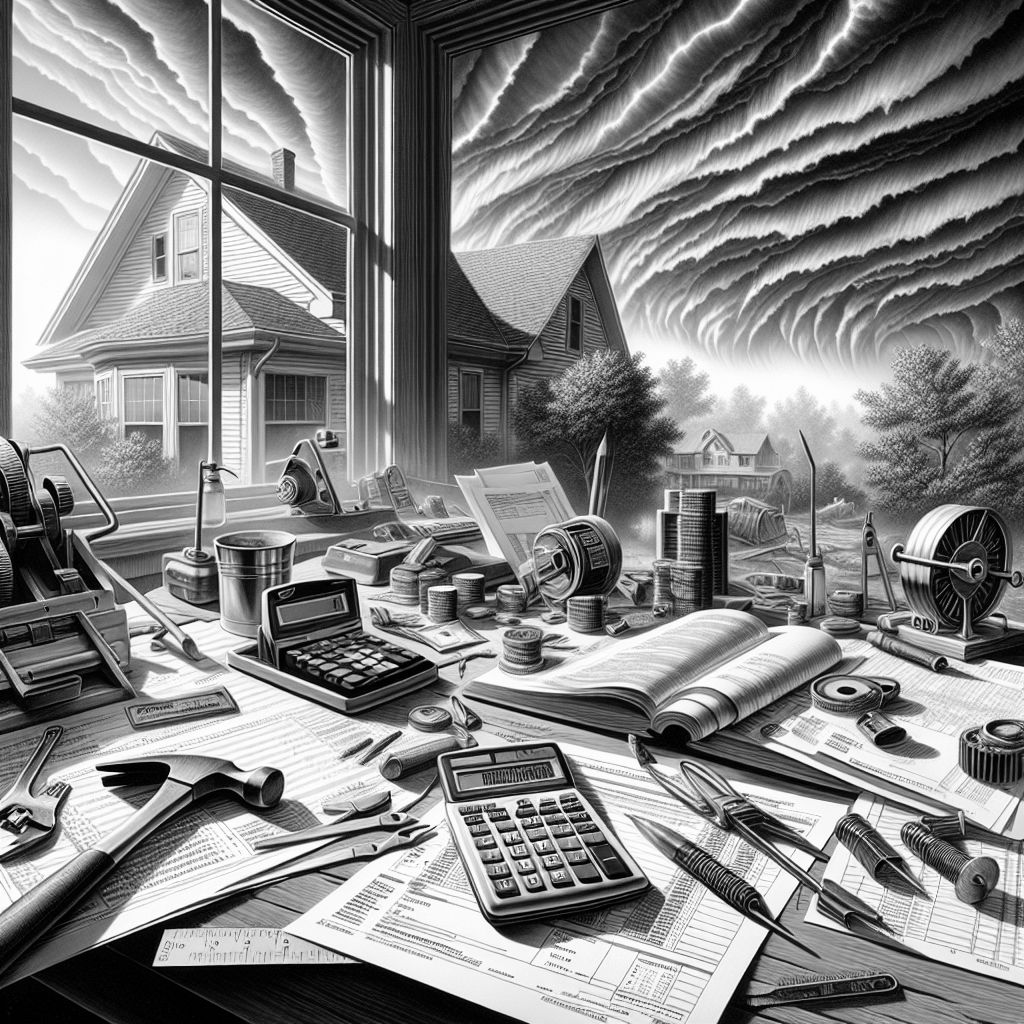

BERLIN / LONDON (IT BOLTWISE) – After a storm, many homeowners are faced with the challenge of repairing the damage caused. But there are tax reliefs that can help reduce the financial burden. However, this support is subject to certain conditions that must be observed.

Today’s daily deals at Amazon! ˗ˋˏ$ˎˊ˗

The tax deductibility of tradesman costs after storm damage is an essential part of the German tax system that supports homeowners. This regulation aims to reduce the financial burden of repair work on privately used residential buildings. A tax bonus can help reduce the cost of labor, travel and machine hours while not taking material costs into account.

There is a separate tax bonus for energy-efficient renovations, which can amount to up to 40,000 euros, spread over three years. A certificate from a specialist company is required for this. It is important that the tax office only recognizes expenses that have been demonstrably transferred in order to prevent undeclared work. Cash payments are therefore not accepted.

The tax bonus covers 20 percent of the costs incurred, but is capped at 1,200 euros per year. This upper limit applies to all tradesman services within a household and not per individual measure. If insurance covers the costs, no tax bonus is possible, except for the deductible. Other regulations apply to rented properties, where tradesman costs can be deducted as business expenses.

Public funding also excludes the right to tax relief. In certain cases, expert work can also be deductible if it is directly linked to the craftsman’s work. This applies, for example, to static calculations before roof repairs. However, independent reports or consulting services are excluded.

*Order an Amazon credit card with no annual fee with a credit limit of 2,000 euros! a‿z

Bestseller No. 1 ᵃ⤻ᶻ “KI Gadgets”

Bestseller No. 2 ᵃ⤻ᶻ “KI Gadgets”

Bestseller No. 3 ᵃ⤻ᶻ “KI Gadgets”

Bestseller No. 4 ᵃ⤻ᶻ “KI Gadgets”

Bestseller No. 5 ᵃ⤻ᶻ “KI Gadgets”

Please send any additions and information to the editorial team by email to de-info[at]it-boltwise.de. Since we cannot rule out AI hallucinations, which rarely occur with AI-generated news and content, we ask you to contact us via email and inform us in the event of false statements or misinformation. Please don’t forget to include the article headline in the email: “Tax deductibility of tradesmen’s costs after storm damage”.

The post Tax deductibility of tradesmen’s costs after storm damage appeared first on Veritas News.