Coming to university might be the first time you’re living independently and having to shop and care for yourself. That means having to think wisely about what you’re spending your money on and whether that purchase is justifiable.

But, luckily for you, Cardiff is a pretty student-budget-friendly city, offering various options to fit different kinds of incomes. So, don’t be scared if you think you’ll be spending a wild amount; there’s plenty of ways to cut costs as long as you stay cautious and sensible (which I promise can actually coincide with a really fun uni experience).

With your new-found independence, it might be difficult to budget. So, we’ve created a list of some of the top tips to guide you during your time at Cardiff Uni.

Set up your student bank account

First and foremost, when dealing with money it’s important to have a secure and reliable bank account. There are many options available so each bank has a set plan they provide. Here are a few of the most popular:

- NatWest offers £85 cash, a four-year-free tastecard and an interest-free overdraft.

- Santander will get you a four-year 16-25 free railcard and interest-free overdraft, but you need a certain amount in your account at all times.

- Nationwide provides £100 cash, £120 in JustEat vouchers, and up to £3000 in your overdraft.

Although all of these deals are good, make sure to check that you’re comfortable with the bank account and that the bank has a chain near you.

Actually utilise your student discounts

The best and most common apps for student discount are Unidays and Student Beans. But if the place you’re shopping at doesn’t appear on these apps don’t be scared to ask if they offer a student discount, because most of the time they will.

By downloading apps and creating memberships/loyalty cards for places you can rack up points and save a lot of money, too. For instance, a Tesco Clubcard, Nectar card or Lidl Plus card can save your pennies in the long run and will make you eligible for certain deals and sales.

Write down your transactions

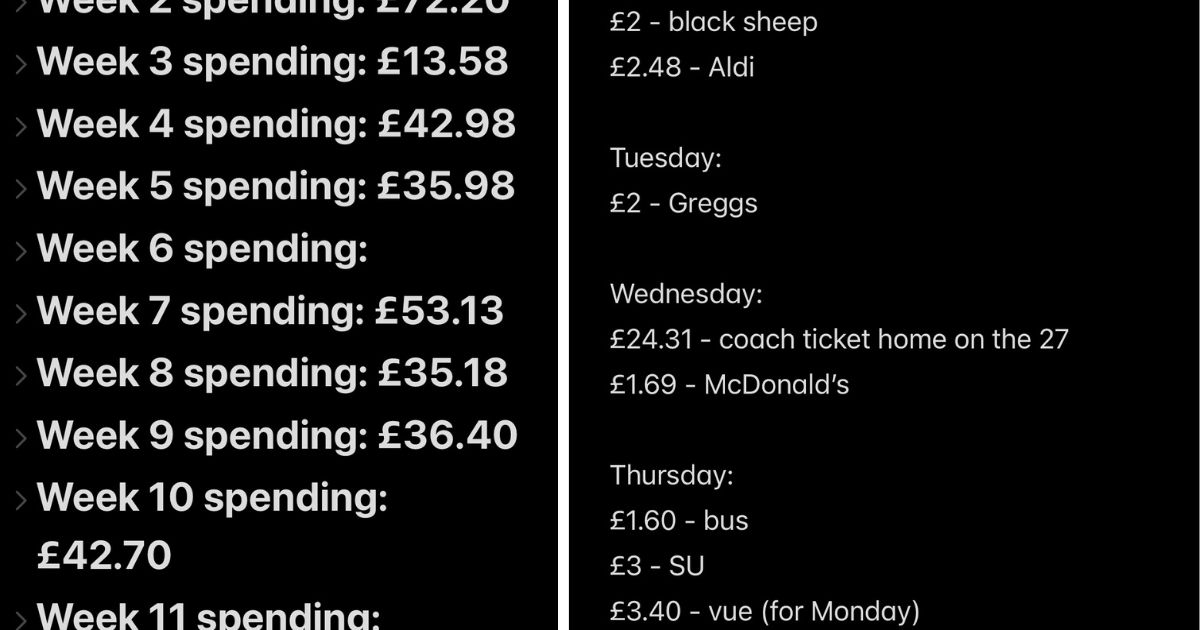

This sounds simple but many don’t do it. In my first year I wrote down every transaction I made, which made it much easier to control my spending and gauge how much I had left for the rest of the week.

By setting a weekly or monthly budget it’ll be easier to track spending and know whether you can actually afford that takeaway or cocktail. At first this can be difficult as you won’t be sure exactly what you’re spending on, and the first couple weeks can be more expensive due to freshers, society costs, etc. But once you’re more settled into uni, it’s much easier to figure out.

Don’t be worried about what others are spending either, as for some a weekly budget can be £50, whereas for other it’s around £200.

Create an excel spreadsheet

Similar to writing your transactions down, but create a spreadsheet of your transactions broken down. The most efficient categories could be, food, transport, going out, laundry, and other.

By splitting up your budget per category you know how much you can and should be spending on different things. For instance, it’s probably more sensible to be spending more money in the week on your food shop than on going out or drinking. But then again, definitely don’t skimp out; money comes and goes but memories don’t.

Make use of travel discount cards

Finally, having a travel discount card is incredibly helpful at uni. Both the 16-25 Railcard and a MyTravelPass are useful for Cardiff students.

From this academic year with a MyTravelPass students can claim a £1 bus fare, making it easier for them to travel around. For getting to and from home your railcard will come in extremely handy as well, as it gives you a third off train fares.

For some it’s cheaper to take the coach, though. For instance a National Express coach from Cardiff University to London Victoria is an average of £20 return, whereas with a railcard a train to London Paddington is £60, and £100 without.

For more of the latest news, guides, gossip, and memes, follow The Cardiff Tab on Instagram, TikTok, and Facebook.